HerraTuohinen

Viimeisimmät viestit

Berkshire Hathaway

25.2.2024 - 01:04

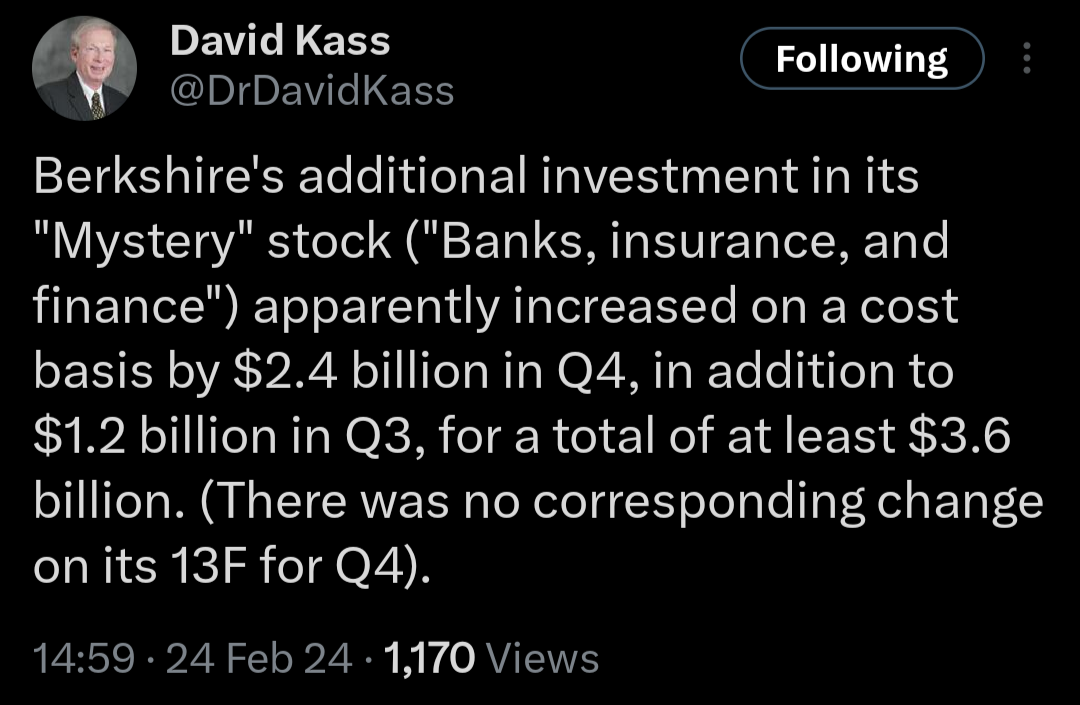

Ei paljastunut Buffettin mysteeriosake vieläkään. Sen verran kuitenkin, että nyt siinä on $3.6 jaardia sijoitettuna.

Markkina tänään: Seuranta- ja kommentointiketju

28.5.2023 - 03:57

Jonkinlainen korkeampi velkakatto ilmeisesti löytynyt. Lupailee hyviä kelejä ensi viikolle.

HUOM, maanantaina on USA-markkinat kiinni.

"White House and House Republicans strike agreement in principle to raise debt ceiling, sources say" https://www.cnn.com/2023/05/27/politics/debt-limit-negotiations-latest/index.html

Kiinalaiset osakkeet ja sijoittaminen Kiinaan

28.3.2023 - 15:01

Ilmeisesti Jack Ma paluu Kiinaan otettiin hyvin vastaan BABA pressä 7% plussalla..

Johtunee ennemminkin tästä:

https://www.reuters.com/technology/alibaba-split-into-six-units-2023-03…

Lisäykset, poistot ja muutokset indekseissä

11.3.2023 - 17:54

Sektori-indekseihin tulee jotain muutoksia ensi perjantaina 17.3.2023, kun luokittelut päivitetään. Merkittävimpinä muutoksina Visa ja Mastercard, jotka ovat olleet Information Technology, siirtyvät porukkaan Financials.

https://www.ssga.com/us/en/individual/etfs/insights/2023-gics-changes-c…

Berkshire Hathaway

25.2.2023 - 22:42

Berkshire Hathawayn omistajille, faneille ja muillekin aiheesta kiinnostuneille olisi taas jykevä paketti tuoretta lukemista.

Uunituore 2022 vuosiraportti yhtiön kotisivuilla. Kannattaa vilkaista ainakin Buffettin kirje. Muilta osin voi sitten selailla numerot, ja leipätekstiä kiinnostuksen mukaan. Pitkäaikaisen holdarin tuota tuskin tarvii kannesta kanteen lukea, kun siellä on aika paljon juttua, joka toistuu vuodesta toiseen. https://www.berkshirehathaway.com/2022ar/linksannual22.html

Sen sijaan Chris Bloomstranin sijoittajakirjeen suosittelen lukemaan ihan kokonaan ja ajatuksella joka vuosi. Kirje on todella jytkyä tavaraa, ja jälkimmäisessä puoliskossa perkaa Berkshire Hathawayn atomeiksi. Jos tuon lukee, ymmärtää ja sisäistää 100%, niin oppii enemmän kuin kymmenestä sijoituskirjasta yhteensä. (Aiheen ohi, mutta... Bloomstran pelasi aikanaan Coloradossa jenkkifudista puolustuksen linjamiehenä.)

https://www.semperaugustus.com/clientletter

Sijoitustieto.fi - Kehitysehdotukset ja palaute

13.12.2021 - 18:43

Androidilla twitter-linkin saa näin:

1. Avaa twiitti

2. Twiitin alareunasta oikealta "share"

3. Klikkaa "copy link"

Pitäisi toimia kuten alla:

https://twitter.com/AkiPyysing/status/1470083919659810828?t=8IjAdkR_gIe…

Berkshire Hathaway

1.3.2021 - 18:05

Pitäisin ennemminkin mahdollisena, että kurssi heilahtaa ylöspäin, kun tieto WB:n lähdöstä aikanaan tulee. Niin kauan kun BRK treidaa alle osien summan, tulee väkisinkin spekulointia osien pilkkomisesta, varojen jakamisesta osinkoina jne. Ajan kanssa sitten palautuu vanhoille urilleen, kun huomataan, ettei mitään radikaalia ole tapahtumassa.

Parhaat set for life vinkit nuorelle jannulle

13.2.2021 - 18:52

Maailmalle rahan tekoon vähintään muutamaksi vuodeksi. Alasta riippuen Piilaakso, Dubai tms. Tai komennusmiehenä johonkin paskavaltioon.

50-100k vuodessa säästöön ihan mahdollinen, kun painaa asenteella hommia ja pitää suomalaisen kulutustason. Vaikuttaa korkoa korolle laskuihin aika rajulla vivulla, kun nuorena käy tekemässä pohjakassan.

Nikola

21.9.2020 - 07:45

Trevor Milton sai lähteä. Taitaa olla viimeinen yritys pitää pakka kasassa.

https://www.freightwaves.com/news/breaking-news-trevor-milton-out-of-ni…

Sijoitustiedon kirjakerho

9.9.2020 - 23:56

Sain lainaan Burton Malkielin Random Walk down Wall Streetin uusimman 2020 painoksen.

Vahva suositus. Tapaan lukea taman opuksen aina, kun uusi painos ilmestyy kirjastoon. Ei silti, etta ihan 100% naita random walk -juttuja allekirjoittaisin, mutta hyva silti muutaman vuoden valein muistuttaa itselleen, etta markkinat on ainakin kohtuullisen tehokkaat suurimman osan ajasta. Pysyy joku tolkku.